Employees' Compensation: Kelly and Another v GE Healthcare Ltd [2009] EWHC 181 (Pat) (11 February 2009)

|

| Jane Lambert |

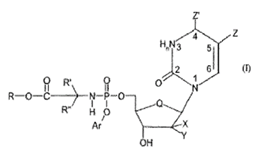

This is the first reported case of a successful contested award under s.40 and s. 41 of the Patents Act 1977. In Kelly and another v GE Healthcare Ltd [2009] EWHC 181 (Pat) (11 Feb 2009). The claimants, Duncan Kelly and Kwok Wai ("Ray") Chiu, were research scientists at Amersham International Plc. They were involved with the first synthesis of a compound called P53, which later formed the basis of a patented radioactive imaging agent which was a highly successful product for their employers. It was sold under the trade mark Myoview. By this action they sought an award of compensation from their employer under s. 40 and s.41 of the Patents Act 1977. They were claiming a share of the benefit which, they say, had been derived by their employer from the patents.

The above sections have now been amended by s.10 of the Patents Act 2004 with respect to patents applied for after 1 Jan 2005. As the applications for the patents in this case had been filed long before that date the old law applied. S.40 of the Act used to provide:

The above sections have now been amended by s.10 of the Patents Act 2004 with respect to patents applied for after 1 Jan 2005. As the applications for the patents in this case had been filed long before that date the old law applied. S.40 of the Act used to provide:

"40 (1) Where it appears to the court or the comptroller on an application made by an employee within the prescribed period that the employee has made an invention belonging to the employer for which a patent has been granted, that the patent is (having regard among other things to the size and nature of the employer's undertaking) of outstanding benefit to the employer and that by reason of those facts it is just that the employee should be awarded compensation to be paid by the employer, the court or the comptroller may award him such compensation of an amount determined under section 41 below.

(2) Where it appears to the court or the comptroller on an application made by an employee within the prescribed period that -

(a) a patent has been granted for an invention made by and belonging to the employee;

(b) his rights in the invention, or in any patent or application for a patent for the invention, have since the appointed day been assigned to the employer or an exclusive licence under the patent or application has since the appointed day been granted to the employer;

(c) the benefit derived by the employee from the contract of assignment, assignation or grant or any ancillary contract ("the relevant contract") is inadequate in relation to the benefit derived by the employer from the patent; and

(d) by reason of those facts it is just that the employee should be awarded compensation to be paid by the employer in addition to the benefit derived from the relevant contract;

the court or the comptroller may award him such compensation of an amount determined under section 41 below. "

Mr. Justice Floyd summarized the law as follows:

"i) Section 40 is available to an inventor in the sense of the "actual deviser" of the invention, but not to those who merely contribute to the invention without being joint inventors;

ii) Section 40 is available to an employee who makes an invention (which is subsequently patented by the employer) in the ordinary course of his employment or in the course of duties specifically assigned to him;

iii) Under the section prior to its amendment, it is the patent (as opposed to the invention) which must be of outstanding benefit to the employer, having regard to the size and nature of the employer's undertaking;

iv) "Outstanding" means "something special" or "out of the ordinary" and more than "substantial", "significant" or "good". The benefit must be something more than one would normally expect to arise from the duties for which the employee is paid;

v) On the other hand it is not necessary to show that the benefit from the patent could not have been exceeded;

vi) Section 40 is not concerned with whether the invention is outstanding, although the nature of the employee's contribution may fall to be considered at the section 41 stage, if it is reached;

vii) It will normally be useful to consider what would have been the position of the company if a patent had not been granted, and compare this with the company's position with the benefit of the patent;

viii) The patent must have been a cause of the benefit, although it does not have to be the only cause. The existence of multiple causes for a benefit does not exclude the benefit from consideration, although the benefit may have to be apportioned to isolate the benefit derived from the patent;

ix) "Patent" in section 40 does not include regulatory data exclusivity ("RDE"). Thus the scenario without patent protection is one where RDE nevertheless exists;

x) It must be "just" to make an award: the consideration of what is just is not limited to the facts set out in section 40;

xi) It is not a requirement of obtaining compensation that the employee can prove a loss (for example by reference to inadequate remuneration for his employment) or by the expenditure of effort and skill beyond the call of duty. These are nevertheless factors to take into account under section 41;

xii) The valuation of any benefit is to be performed ex-post and in the light of all the available evidence as to benefit derived from the patent: not "ex-ante";

xiii) Where the employee shows that the invention has been of outstanding benefit, the amount of compensation is to be determined in the light of all the available evidence in accordance with section 41 so as to secure a just and fair reward to the employee, neither limiting him to compensation for loss or damage, nor placing him in as strong a position as an external patentee or licensor."

Applying those rules the judge found that

i) The patents had been of outstanding benefit to Amersham;

ii) It was just that the employees should receive an award of compensation;

iii) the benefit of the patents was of the order of £50 million;

iv) A fair share for the employees was £1 million for Dr Kelly and £500,000 for Dr Chiu.

(2) Where it appears to the court or the comptroller on an application made by an employee within the prescribed period that -

(a) a patent has been granted for an invention made by and belonging to the employee;

(b) his rights in the invention, or in any patent or application for a patent for the invention, have since the appointed day been assigned to the employer or an exclusive licence under the patent or application has since the appointed day been granted to the employer;

(c) the benefit derived by the employee from the contract of assignment, assignation or grant or any ancillary contract ("the relevant contract") is inadequate in relation to the benefit derived by the employer from the patent; and

(d) by reason of those facts it is just that the employee should be awarded compensation to be paid by the employer in addition to the benefit derived from the relevant contract;

the court or the comptroller may award him such compensation of an amount determined under section 41 below. "

Mr. Justice Floyd summarized the law as follows:

"i) Section 40 is available to an inventor in the sense of the "actual deviser" of the invention, but not to those who merely contribute to the invention without being joint inventors;

ii) Section 40 is available to an employee who makes an invention (which is subsequently patented by the employer) in the ordinary course of his employment or in the course of duties specifically assigned to him;

iii) Under the section prior to its amendment, it is the patent (as opposed to the invention) which must be of outstanding benefit to the employer, having regard to the size and nature of the employer's undertaking;

iv) "Outstanding" means "something special" or "out of the ordinary" and more than "substantial", "significant" or "good". The benefit must be something more than one would normally expect to arise from the duties for which the employee is paid;

v) On the other hand it is not necessary to show that the benefit from the patent could not have been exceeded;

vi) Section 40 is not concerned with whether the invention is outstanding, although the nature of the employee's contribution may fall to be considered at the section 41 stage, if it is reached;

vii) It will normally be useful to consider what would have been the position of the company if a patent had not been granted, and compare this with the company's position with the benefit of the patent;

viii) The patent must have been a cause of the benefit, although it does not have to be the only cause. The existence of multiple causes for a benefit does not exclude the benefit from consideration, although the benefit may have to be apportioned to isolate the benefit derived from the patent;

ix) "Patent" in section 40 does not include regulatory data exclusivity ("RDE"). Thus the scenario without patent protection is one where RDE nevertheless exists;

x) It must be "just" to make an award: the consideration of what is just is not limited to the facts set out in section 40;

xi) It is not a requirement of obtaining compensation that the employee can prove a loss (for example by reference to inadequate remuneration for his employment) or by the expenditure of effort and skill beyond the call of duty. These are nevertheless factors to take into account under section 41;

xii) The valuation of any benefit is to be performed ex-post and in the light of all the available evidence as to benefit derived from the patent: not "ex-ante";

xiii) Where the employee shows that the invention has been of outstanding benefit, the amount of compensation is to be determined in the light of all the available evidence in accordance with section 41 so as to secure a just and fair reward to the employee, neither limiting him to compensation for loss or damage, nor placing him in as strong a position as an external patentee or licensor."

Applying those rules the judge found that

i) The patents had been of outstanding benefit to Amersham;

ii) It was just that the employees should receive an award of compensation;

iii) the benefit of the patents was of the order of £50 million;

iv) A fair share for the employees was £1 million for Dr Kelly and £500,000 for Dr Chiu.

Comments